Why I hate banks!

An argument for lower margins

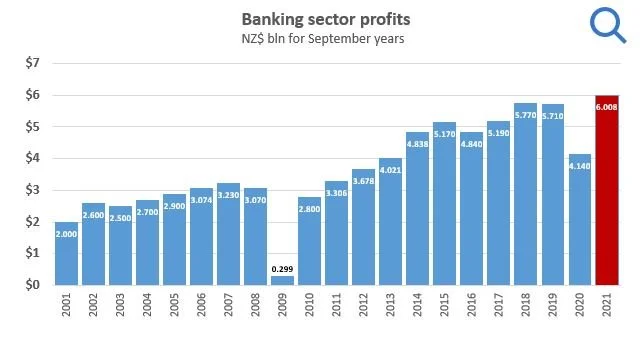

Banks are making eye-watering profits.

Banks always make eye-watering profits. The blip in their ever increasing profits was due to the Great Financial Crisis - a crisis that was a result of bank greed.

The outcome from banking is that money is transferred from poorer people (borrowers) to wealthier people (investors). That’s it.

Banks don’t compete, they are in an oligopoly (a state of limited competition, in which a market is shared by a small number of producers or sellers). Left to the market (a fantasy created by magic thinking), they will continue to make sh!tloads.

Given the Reserve Bank of New Zealand regulates the banking industry (creating an argument that they are instruments of the Government) why not regulate the margins they can charge?